File Your CTA Compliance Data Quickly And Easily With The FinCEN FilePro Full Service Solution!

Compliance Solutions Built With Your Business In Mind.

Certain companies are required under the Corporate Transparency Act (CTA) to report beneficial ownership information (BOI) to FinCEN, which is a branch of the United States Department of Treasury. Increased corporate transparency and the fight against illegal financial activity are the goals of the CTA, which entered into force on January 1, 2024.

Trusted by hundreds of companies

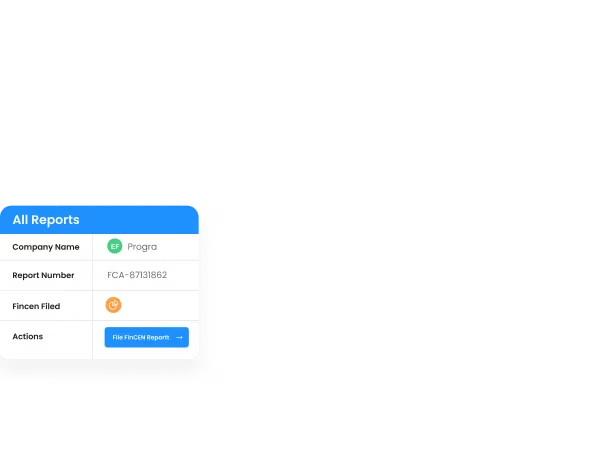

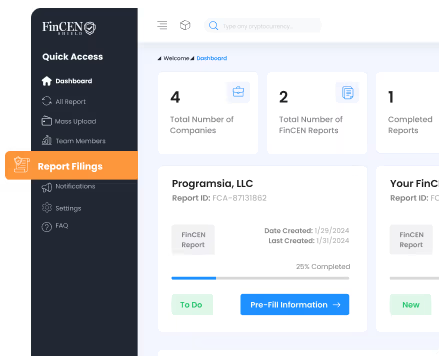

Here at FinCEN Advisors, we make it easy and safe for company owners to comply with reporting regulations in the United States. Online submission of critical information is made easy with our platform’s user-friendly FilePro solution. Certified security measures guarantee privacy, and our digital filing process speeds up your Federal compliance process.

Here at FinCEN Advisors, we make it easy and safe for company owners to comply with reporting regulations in the United States. Online submission of critical information is made easy with our platform’s user-friendly FilePro solution. Certified security measures guarantee privacy, and our digital filing process speeds up your Federal compliance process.

Fill out the form to download our e-book

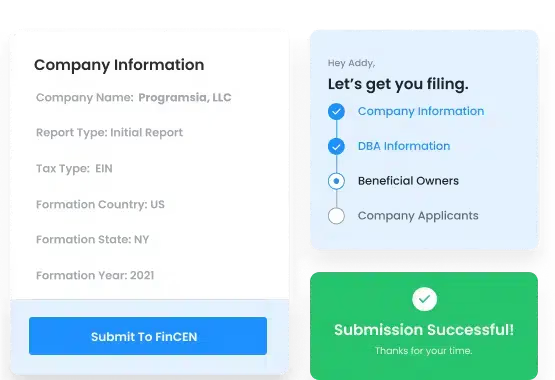

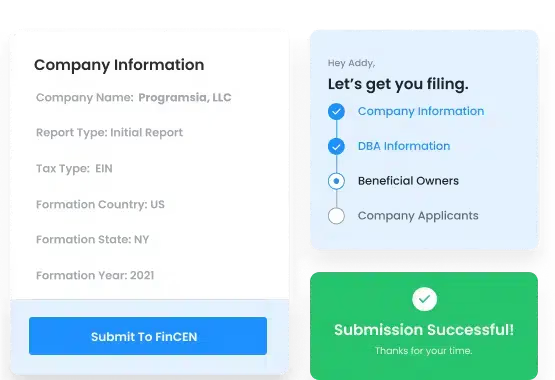

Our expert team will create and submit a fully compliant beneficial ownership report to FinCEN on your behalf, ensuring compliance and a stress-free process for you and your business.

Once we’ve filed your report with FinCEN, we’ll instantly send you a confirmation. This ensures you’re well-informed and at ease, knowing that you have fulfilled your reporting requirements.

Ensuring compliance should not be a daunting task. Get the flexibility and user-friendliness you deserve with capabilities like:

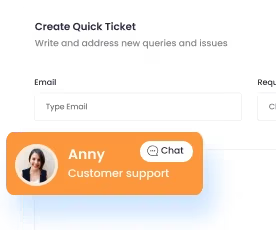

Personalized assistance for any questions or concerns about compliance. Help tailored to each individual's needs to facilitate a trouble-free compliance procedure.

Save time and effort with our user-friendly platform to upload and organize all your important documents. Submit your papers online quickly and securely, saving you time.

Take advantage of the flexibility to revise and update your filings as often as you like. You can easily adapt to changing company demands with only a few clicks.

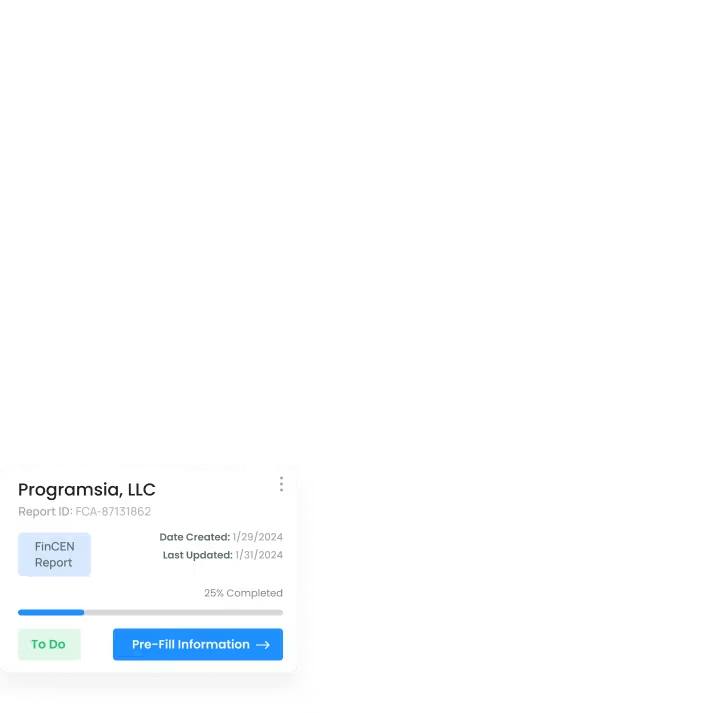

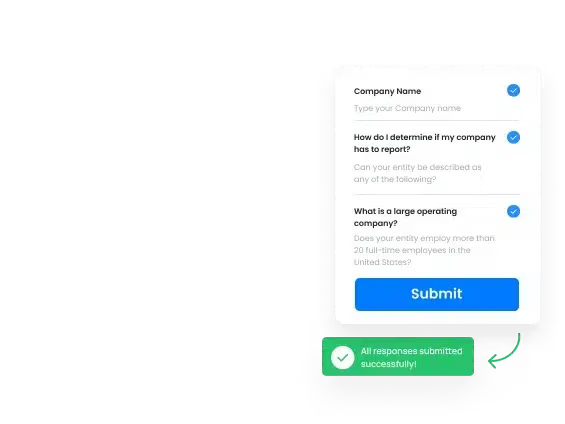

Try out our digital filing system and see how efficient it is. With only a few clicks, your CTA compliance data is prepared, and with our user-friendly platform, we streamline the process to ensure quick compliance.

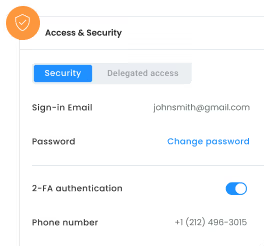

Our top-tier security procedures safeguard your sensitive data at every stage, ensuring that your confidentiality is our top priority. Rest assured that your data is always protected by our cutting-edge software.

Important dates and any changes to compliance standards will be communicated to you in advance. Your file will be reviewed by FinCEN Advisors to make sure it complies with the Corporate Transparency Act.

It can be difficult to understand the finer points of a new statute that imposes criminal and civil penalties like fines and jail time. Employing our easy-to-use and accurate filing service can relieve you of the burden and risk associated with compliance.

Our simplified, multi-step filing process will reduce ambiguity.

We take the protection of your personally identifiable information (PII) very seriously.

Significantly less time is spent on filing thanks to our straightforward automated system. Remove the possibility of serious legal repercussions (both civil and criminal) for noncompliance.

Choose the ideal FinCEN compliance plan for your business from our comprehensive range, designed to meet the demands of companies of all sizes.

Individual business owners who are solely responsible for making decisions for their business. Includes one BOI filing for One Beneficial Owner.

All the same benefits that come with the starter package and an additional BOI report filing. Ideal for businesses with two beneficial owners.

For businesses with multiple beneficial owners or multiple individuals with decision-making power. Ideal for businesses with complex filings.

The intricacies of CTA compliance and FinCEN registration were the inspiration for FinCEN’s FilePro system, which was created by financial, legal, and technological specialists. To help company owners streamline these important procedures, we provide direct services for FinCEN registration and CTA compliance.

Try out our digital filing system and see how much easier it is to submit documents for rapid compliance.

Our top-tier security procedures safeguard your sensitive data at every stage, ensuring that your confidentiality is our top priority.

Trust our knowledgeable support staff to help you with any questions and to walk you through the filing procedure.

Navigating the Corporate Transparency Act and FinCEN’s regulations can be complex. We’ve compiled a comprehensive FAQ to provide you with clear, direct answers to your most pressing questions, ensuring you have the knowledge to maintain compliance confidently.

FinCEN stands for the Financial Crimes Enforcement Network. It is a bureau of the United States Department of the Treasury. FinCEN’s mission is to safeguard the financial system from illicit use and combat money laundering and financial crimes.

FinCEN imposes various reporting requirements on financial institutions and certain businesses to help detect and prevent money laundering and other financial crimes. Common reporting requirements include Currency Transaction Reports (CTRs) for transactions over a certain threshold, Suspicious Activity Reports (SARs) for suspicious transactions, and reports related to certain foreign financial accounts (FBAR).

Failure to comply with FinCEN reporting requirements can result in severe penalties. Penalties may include civil and criminal penalties, fines, and, in extreme cases, imprisonment. The specific consequences depend on the nature and severity of the violation.

The purpose of the Corporate Transparency Act (CTA) is to prevent and deter money laundering, terrorist financing, and other illicit financial activities. It aims to enhance the transparency of business entities by requiring them to disclose information about their beneficial owners. The CTA was enacted to provide crucial information to law enforcement agencies for investigations and analyses, to improve the integrity of information available to financial institutions conducting due diligence, and to assist in the detection and prevention of illicit activities. By requiring companies to provide this ownership information, the CTA closes loopholes that could otherwise be exploited by persons engaged in illegal enterprises.

Beneficial Owners: Entities must identify their beneficial owners, defined as individuals who either own 25% or more of the equity interests of the entity or exercise substantial control over the entity.

25% Ownership: The 25% ownership criterion for Beneficial Ownership Information (BOI) reporting refers to individuals who directly or indirectly own at least a 25% equity interest in a company or legal entity. This includes any form of equity, such as shares, capital, or profits.

Substantial Control: “Substantial control” in the context of Beneficial Ownership Information (BOI) refers to the authority to make significant decisions affecting the entity, regardless of equity ownership. This could include senior officers, executives, or anyone else who has significant influence over the company’s operations, policies, or financial transactions.

To qualify as a “large operating company” and be exempt from the Beneficial Ownership Information (BOI) reporting requirements, an entity must meet all of the following criteria:

Under the Corporate Transparency Act (CTA), the following entities are generally required to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN):

The CTA aims to cover entities that might otherwise be used to conceal ownership and control to facilitate illicit activities. Entities need to review the CTA’s provisions or consult with legal counsel to determine whether they are subject to the reporting requirements or if they qualify for any exemptions.

Fill out the contact form below, and a member of our team will reach out to you shortly.

7301A West Palmetto Park Road

Suite 204B

Boca Raton, FL 33433

FinCen Advisors specializes in helping businesses comply with the Corporate Transparency Act and Beneficial Owner Information (BOI) filing requirements. We offer clear, stress-free solutions to ensure reporting obligations are met with ease, providing businesses with confidence and peace of mind in their compliance journey.

Please note that we are an independent advisory and report management firm and are not affiliated with the official Financial Crimes Enforcement Network website, FinCEN.gov.

Use Code: SAVE10

Wait, Don’t Go!

Before you leave, we want to offer you an exclusive 10% discount on your first service with us. Don’t miss out on this limited-time offer to ensure your business stays compliant with BOI reporting requirements!

Join thousands of businesses that trust and utilize our services.

Join thousands of businesses that trust and utilize our services.