Save Time With Our

BOI Filing Software

FinCEN Advisors' CTA Filing Platform for Accounting and Legal Firms

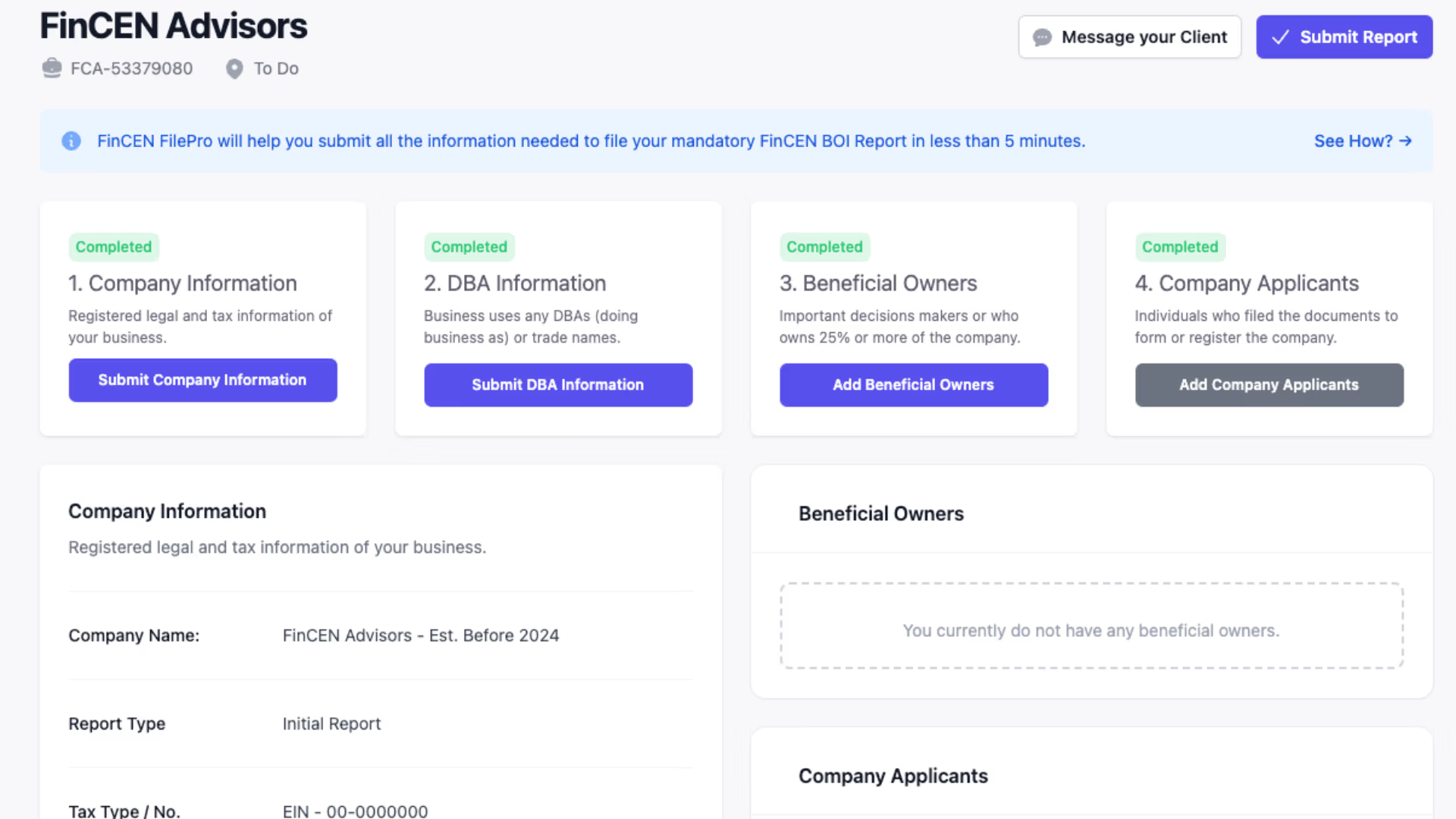

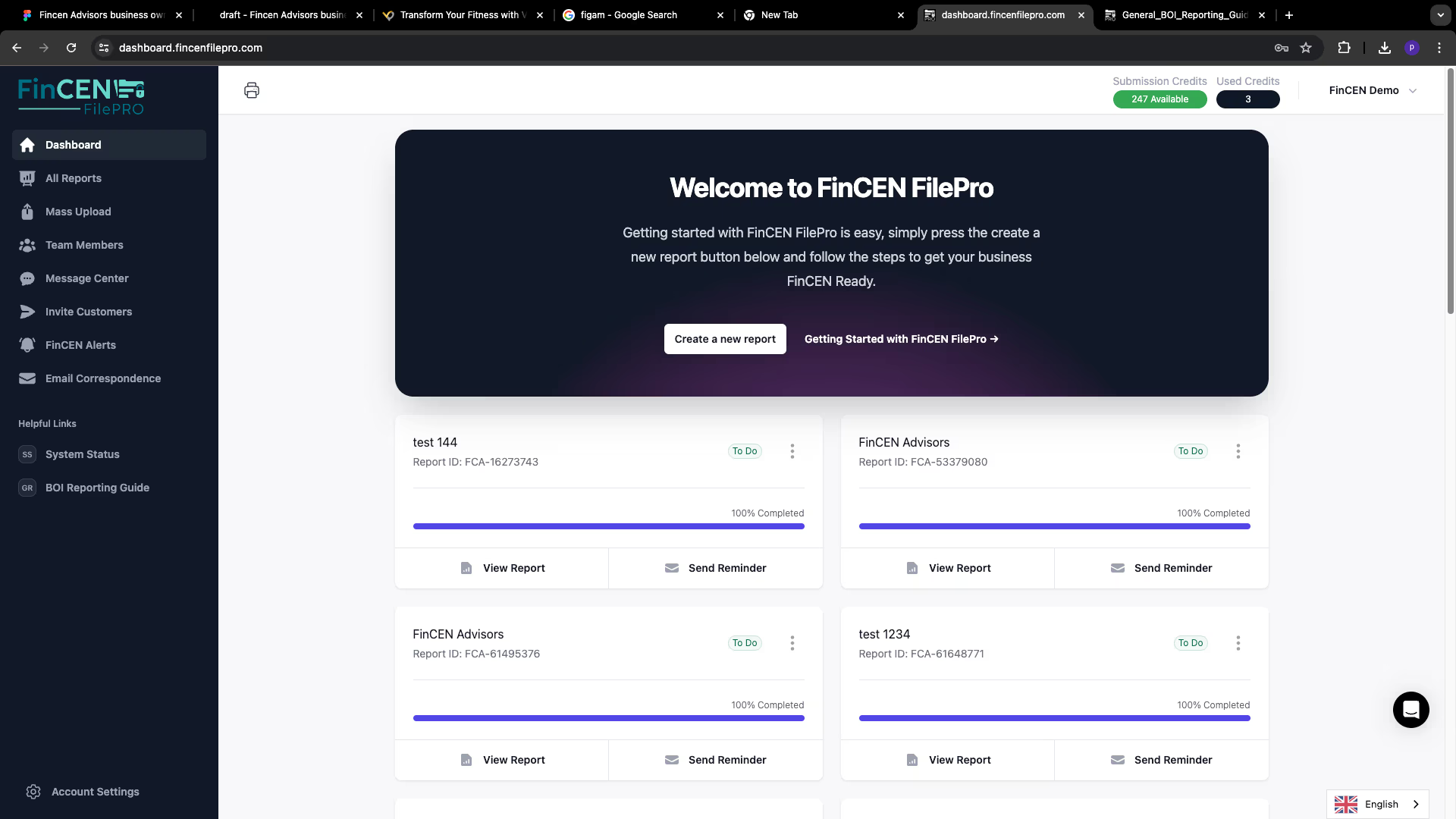

Understanding the unique challenges faced by professional firms, including legal, accounting, and business formation entities, FinCEN Advisors offers a comprehensive range of services enhanced by our exclusive white label software, FinCEN FilePro. This tool is expertly designed to simplify the collection and organization of client filing information.

Simplifying Corporate

Transparency Act Compliance

Welcome to FinCEN Advisors, where we provide comprehensive filing solutions for both individual businesses and professional firms to comply with the Corporate Transparency Act (CTA).

Our Best Features & Services

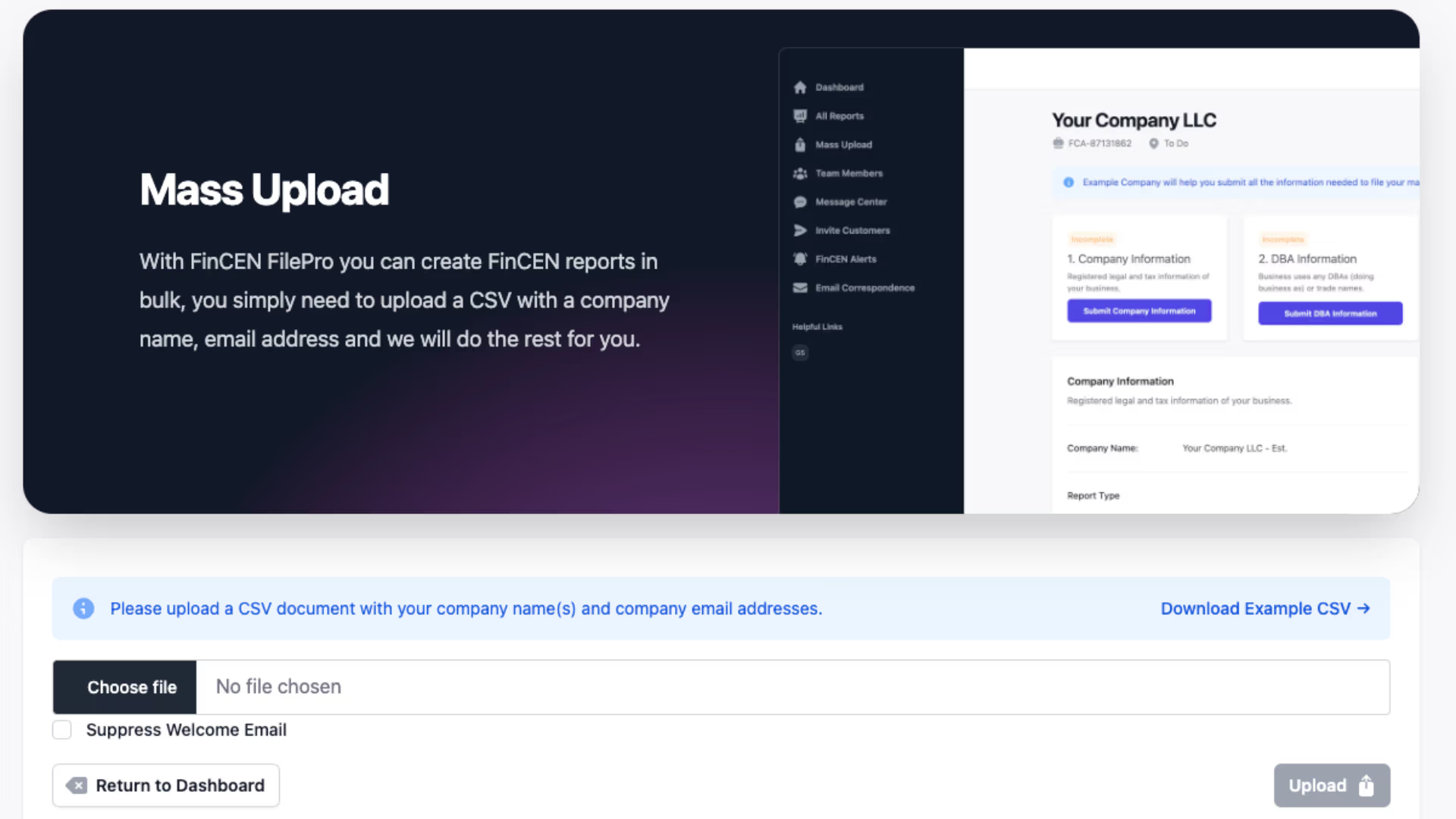

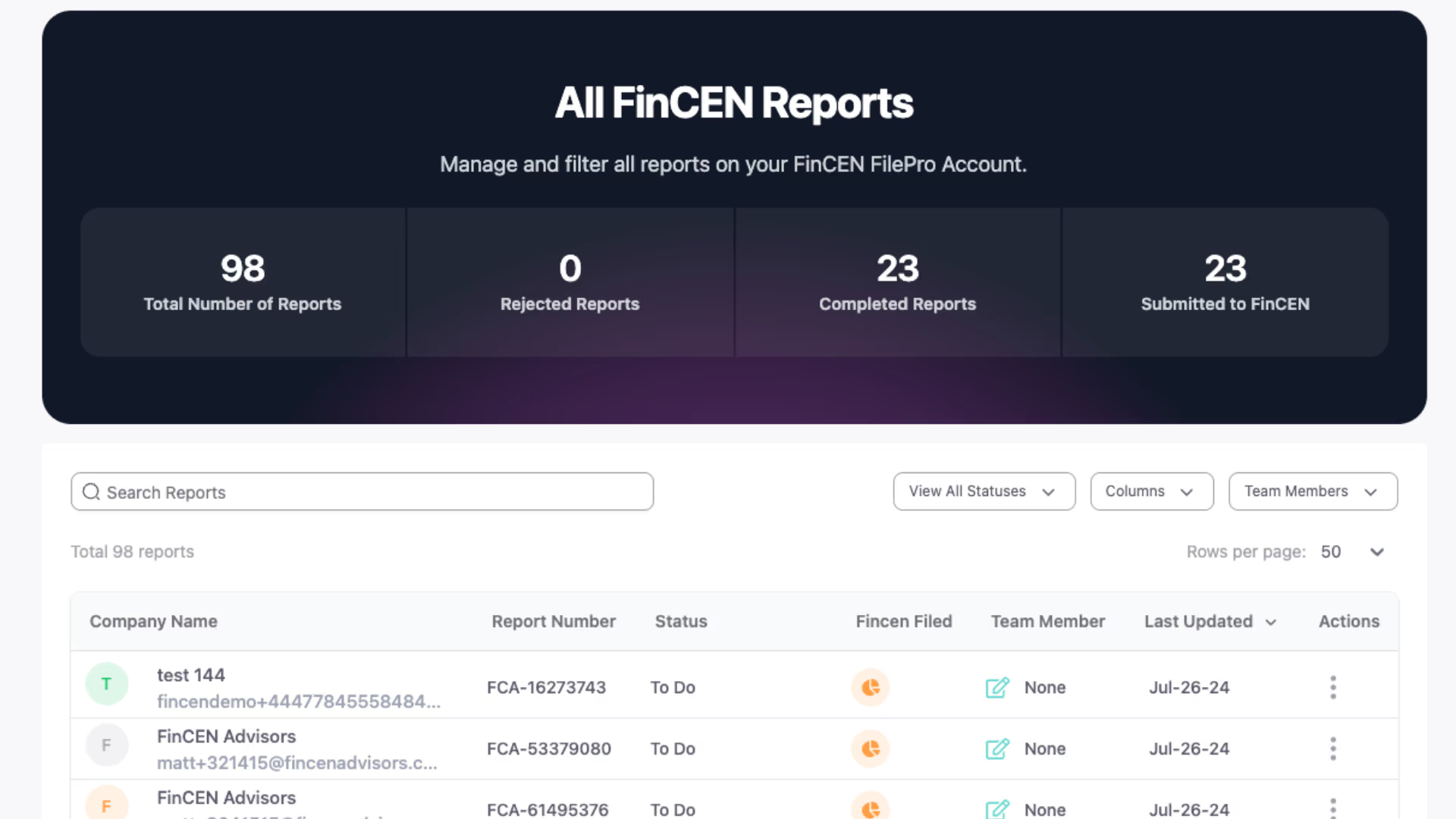

FinCEN FilePRO provides a groundbreaking opportunity for CPAs, attorneys, and formation companies to efficiently handle client filings. The software not only simplifies compliance but also enhances your firm’s service offerings and revenue potential. Key benefits include:

Seamless Integration Into Your Workflow

FinCEN FilePRO fits effortlessly into your existing processes, reducing the learning curve and improving operational efficiency.

Enhanced Security and Data Management

Protect sensitive client information with robust security measures, ensuring data integrity and compliance.

Revenue Growth Through CTA Compliance

By handling 10 to 20 times more filings than traditional methods, your firm can capitalize on the growing demand for CTA compliance services.

Demo The FinCEN FilePRO BOI Filing Software Today

Real-Time Data Analysis

Save Time & Effort

Improve Decision-Making

Custom Branded Interface

Let's Start A Conversation

Let's Start A Conversation

Key Benefits:

Whether you’re looking to streamline your business’s compliance processes, enhance your firm’s client services, or empower your association members with essential resources, we have the expertise and solutions to meet your compliance needs.

Customized Financial Strategies

We offer tailored solutions to ensure your business meets all regulatory requirements efficiently and accurately, allowing you to focus on what you do best.

Expert Team

Partner with us to elevate your compliance offerings and enhance your value to clients.

Proven Results

Let us be your guide in fostering a culture of transparency and regulatory adherence within your member community.

Frequently asked questions

| Securities reporting issuer | Governmental authority | Bank |

| Credit union | Depository institution holding company | Money services business |

| Broker or dealer in securities | Securities exchange or clearing agency | Other Exchange Act registered entity |

| Investment company or investment adviser | Venture capital fund adviser | Insurance company |

| State-licensed insurance producer | Commodity Exchange Act registered entity | Accounting firm |

| Public utility | Financial market utility | Pooled investment vehicle |

| Tax-exempt entity | Entity assisting a tax-exempt entity | Large operating company |

| Subsidiary of certain exempt entities | Inactive entity |

Beneficial Owners: Entities must identify their beneficial owners, defined as individuals who either own 25% or more of the equity interests of the entity or exercise substantial control over the entity.

25% Ownership: The 25% ownership criterion for Beneficial Ownership Information (BOI) reporting refers to individuals who directly or indirectly own at least a 25% equity interest in a company or legal entity. This includes any form of equity, such as shares, capital, or profits.

Substantial Control: “Substantial control” in the context of Beneficial Ownership Information (BOI) refers to the authority to make significant decisions affecting the entity, regardless of equity ownership. This could include senior officers, executives, or anyone else who has significant influence over the company’s operations, policies, or financial transactions.

To qualify as a “large operating company” and be exempt from the Beneficial Ownership Information (BOI) reporting requirements, an entity must meet all of the following criteria:

- Employment: The entity must employ more than 20 full-time employees in the United States.

- Operating Presence: The entity needs to have an operating presence at a physical office within the United States, which is a location that the entity owns or leases and is distinct from any other unaffiliated entity.

- Gross Receipts or Sales: The entity must have filed a federal income tax or information return in the United States for the previous year showing more than $5,000,000 in gross receipts or sales. This amount should be net of returns and allowances. If the entity is part of an affiliated group of corporations, the consolidated return for the group applies.

Under the Corporate Transparency Act (CTA), the following entities are generally required to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN):

- Corporations, LLCs, and Other Similar Entities: This includes corporations, limited liability companies, and other entities that are created by filing a formation document with a state office, such as a secretary of state.

- Foreign Entities: Certain foreign entities that are registered to do business in the United States must also report beneficial ownership information to FinCEN.

The CTA aims to cover entities that might otherwise be used to conceal ownership and control to facilitate illicit activities. Entities need to review the CTA’s provisions or consult with legal counsel to determine whether they are subject to the reporting requirements or if they qualify for any exemptions.

For beneficial ownership reporting under the Corporate Transparency Act (CTA), the required information typically includes:

- Identifying Information of Beneficial Owners: This covers the name, date of birth, address, and an identification number (such as a passport number or driver’s license number) for each beneficial owner. You will need a scanned image of your non-expired Government-issued ID (driver’s license, state-issued government ID, passport) ready for upload to the FinCEN FilePro system.

- Details of Ownership or Control: Information about the nature and extent of the beneficial ownership or control exercised by each individual.

- Entity Details: Information about the reporting entity itself, including its name, business address, and, if applicable, its online presence.

- Identification of Filer: The individual submitting the information must also provide their details, including their name and contact information.

This information helps authorities understand who ultimately owns, controls, or benefits from a company and can be crucial in efforts to combat financial crimes like money laundering and terrorist financing.

Under the Corporate Transparency Act (CTA), a “beneficial owner” is defined as an individual who, either directly or indirectly, meets one or both of the following criteria:

- Exercises Substantial Control: This refers to an individual who has significant influence over or responsibility for key decisions regarding the entity’s operations, finances, or other significant matters.

- Owns or Controls a Substantial Interest: This typically means an individual who owns or controls at least 25% of the ownership interests in the entity.

The definition is designed to identify individuals who have the authority to exert significant influence over a company or who hold a substantial ownership stake in it.